Stand Up and Be Heard!

If you are available December 8 at 7 pm – please attend the City Council Meeting in the Esther Howland Chamber on the third floor of Worcester City Hall to show the Council that the business community supports Line 191.

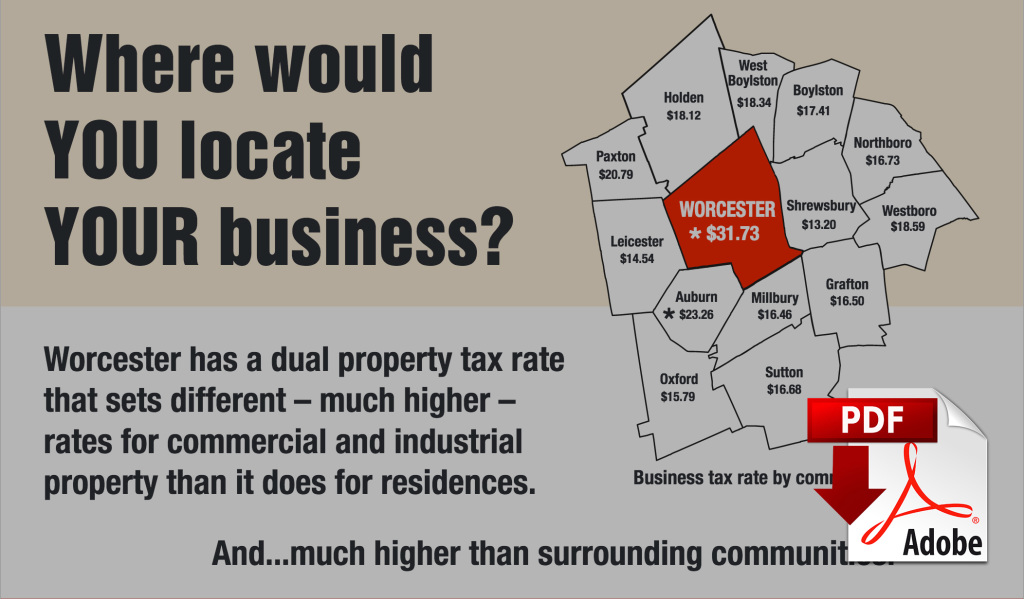

Why We Need a Fair and Equitable Tax Rate

Successful Worcester businesses are faced with tough choices…

Prime-Air Blowers

Alex Trenta, owner of Prime-Air Blower, Inc., chose to start his business in Worcester because “everything is nearby or right around the corner,” including the rail port authority, which he uses to exports his products from Main South to overseas.

When the opportunity arose to purchase the building he was renting space in at 118 Cambridge Street, Alex decided it would be a good investment and would provide security to the tenants. Today, Cambridge Crossings has eight tenants, including Prime-Air.

Since 2012, Alex’s tax bills have increased to well over $8,000. Hesitant to pass too much of the burden on to his small-business owner tenants, Prime-Air continues to shoulder more of the burden. Couple these high taxes with the rising cost of health care, increasing sewer and water rates, and Alex is finding it hard to operate his successful Worcester business.

EVO and The Living Earth

The Maykels opened the popular EVO restaurant in Worcester in 2008, with a model to create heart-conscious culinary delights. Like many successful business owners, the Maykels  have considered expanding beyond their Chandler Street location and growing their workforce of roughly 48 employees.

have considered expanding beyond their Chandler Street location and growing their workforce of roughly 48 employees.

However, the rising minimum wages, the high cost of food and inventory, the constant volatility of energy costs, and the city’s high tax rate have left the family-owned business discouraged. Since 2012, the Maykel’s have seen a 13% jump in their taxes.

“Small businesses struggle to make ends meet and it is important to our family to continue to provide our customers with a place to purchase natural and organic foods; that becomes harder and harder with ever increasing costs,” said Albert Maykel, Jr. from the Living Earth.

Standard Auto

Since 1973, the Stultz family has owned and operated Standard Auto Wrecking on Granite Street in Worcester. Worcester made sense because “it has everything” and their loyal customer base knows where they are located. The auto parts dealer has done everything to keep costs low by modernizing processes but running a company in Worcester has been difficult. In 2012, Standard Auto saw their valuations, for their three parcels, increase by 74 percent, with a 44% increase in their taxes! Everyday becomes more of a challenge for Standard Auto Wrecking to keep their doors open.

Stand Up. Be Heard. Support a fair tax rate for businesses and residents.

Tuesday, December 8 | 7 pm | Worcester City Hall

The Chamber and business community nearly suffered a massive set-back during the City Council’s Tax Classification hearing held on 11/24/15; however we have been given a reprieve and we need all the help we can muster from you, our board, and our members.

We must contact the 6 councilors below who voted for line 212 and ask that they reconsider and vote for line 187.

Line 212 would have represented an average total increase of $1,386 [or a $756 median increase] for business owners who also live in the city; while line 187 would be an average increase just over a $500 [or a $524 median increase] for the business owners who also reside in the city.

To those of you who not only own businesses and work in the city, but also live here, please help them recognize that it is especially onerous on you. A $700 increase in your business property taxes is not offset by a $700 decrease in your residential taxes.

We must help these councilors to understand the long-term negative impact this vote will have on businesses; we ask that you politely explain your story and what this increase means for your business.

We are not sure they recognize that as costs go up, businesses need to consider their options, one of which could be to move out of the city; and while this point is important we would respectfully request that you not threaten to leave the city, this has a negative impact on most councilors as they feel they are being backed into a corner with ultimatums of this nature.

Contact These City Councilors:

It is imperative that collectively, we impress upon these city councilors the severe impact that an almost $700 average increase would have on the business community, especially the small businesses. Please ask them to vote for line 187 – a fair and equitable vote.

1.) Councilor Moe Bergman – bergmanm@worcesterma.gov; (508) 868-5291 – city issued cell phone

2.) Councilor Michael Gaffney – gaffneym@worcesterma.gov; (508) 868-6878 – city issued cell phone

3.) Councilor Sarai Rivera – riverasa@worcesterma.gov; (508) 963-3822 – city issued cell phone

4.) Councilor Gary Rosen – roseng@worcesterma.gov; (508) 755-3006 – home phone

5.) Councilor Konnie Lukes – lukesk@worcesterma.gov; (508) 425-0042

6.) Councilor George Russell – russellg@worcesterma.gov; (508) 963-6320