WORCESTER – Recent tax relief and relocation developments in the city underscore the need for a more equitable dual or even single rate to combat burdens affecting many businesses.

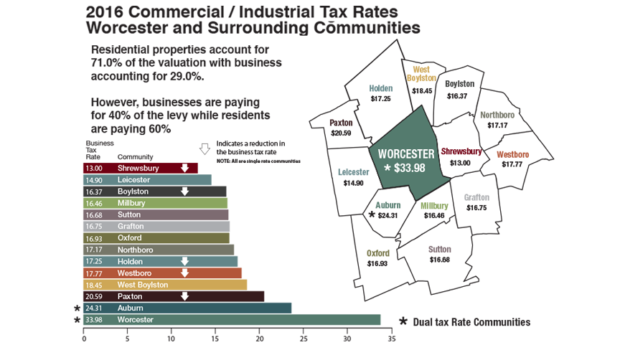

With a City Council vote scheduled soon to set a new residential and commercial/industrial levy, the FY 2016 Worcester residential tax rate remains $20.61 per $1,000 assessed valuation. Additionally, the commercial/industrial property tax rate is currently $33.98. That commercial rate will rise even further in Fiscal Year 2017. In comparison, Worcester’s FY 2015 residential tax rate of $20.07 per $1,000 assessed valuation and commercial/industrial tax rate at $31.73 clearly demonstrates the rising trend.

The city of Worcester provides Tax Increment Financing (TIF) Plans to increase commercial property values. Also, the development device helps retain existing Worcester businesses interested in expanding its operations. Additionally, it attracts new business and private development to the city. Finally, it reduces financial risk to ensure development projects move forward and become successful. However, when Worcester’s residential tax rate is applied to the overall tax levy in comparison to commercial/industrial properties, TIFs account for only a small fraction. There is also ceiling on how many TIFs any municipality can afford to negotiate.

TIFs only take city so far

The widening tax disparity that exists is most profound in the recent decision by Curtis Industries, LLC to leave Worcester. That company enjoys a 50-year history operating in the city. In 2017, Curtis is moving from Worcester and taking advantage of West Boylston’s much lower single tax rate of $18.45 per $1,000 of assessed valuation – almost half that of Worcester’s commercial rate. Additionally, the deal comes with a separate $803,000 TIF approved by West Boylston voters last August.

The deal gives the maker of vehicle cabs and accessories a two-year, 100 percent tax elimination period on a new $8 million, 110,000square foot addition at 70 Hartwell St. in West Boylston. The building will occup a 163,000-square-foot lease. It is unclear what property tax liability will exist, or if future tenants will immediately occupy Curtis Industries’ existing 150,000-square-foot Worcester headquarters and three other city locations. The company plans to move to West Boylston in July 2017 when construction is completed.

GFI needed TIF to attract Imperial

While limited by financial constraints, Worcester continually demonstrates its commitment to providing expert resources and TIFs to build new, first class commercial/ industrial spaces. Also, TIFs provide more jobs and bring in more retail consumers. That said, the economic development tool can only take the city so far.

A TIF agreement formed last year between the city and GFI Partners is the primary catalyst for a new 610,000-square-foot 150 Blackstone River Road warehouse development. After completion, a 15-year TIF propelling the $26 million, 36-acre redevelopment will create about 300 new jobs over five years. Also, it will generate $1.4 million in property tax revenues annually. Tenants include Auburn-based Imperial Distributors, existing tenant Mid-State Packaging, and Gallo Wines.

“Steve Goodman (Founding Partner at GFI) would not have been able to offer a competitive lease price to Imperial,” said Timothy P. Murray, President & CEO of the Worcester Regional Chamber of Commerce. “This only happened here because we artificially reduced the commercial/industrial tax rate via a TIF. We feel more businesses would strongly consider Worcester as a prime development location if the tax rate is lower.”

Table Talk Pies comes to Worcester

Juxtaposed between the city’s Curtis Industries and GFI Partners experiences sits one of its newest TIF applicants, Chacharone Properties. That company is seeking tax relief in order to allow Table Talk Pies to relocate from Shrewsbury to the city. Table Talk plans to construct a new $4.6 million, 50,000-square-foot building in the South Worcester Industrial Park. The TIF, which was approved by the City Council in September, would make the city’s tax rate more competitive.

The company hopes to begin construction this fall following state review of the TIF. Additionally, the company plans to move 30 employees here and add 50 new jobs over five years. Without the TIF, the relocation would never have happened under the city’s high commercial tax rate. Table Talk moved some of its operations to Shrewsbury a few years ago because of a similar TIF deal struck there. Also, Shrewsbury offers a much lower single tax rate of $10.67 per $1,000 of assessed valuation.

Businesses pay 60 percent of tax levy in Worcester

As it now stands, Worcester sits at a competitive disadvantage to surrounding towns’ tax rate structures. Every year the Chamber compiles a fiscal analysis of the region’s residential and commercial/ industrial tax rates. In 2016, Worcester residential properties accounted for 71 percent of property valuations with businesses accounting for 29 percent. However, businesses are paying for 40 percent of the levy. In comparison, residents are paying only 60 percent. This forced an 11 percent or $30 million shift of Worcester’s residential levy to commercial/industrial properties in 2016. Most tax rates in surrounding towns are also going down or holding stable. Worcester’s commercial tax rate has steadily risen for many years. Most concerning, the city is only one of two municipalities out of 14 area towns that still utilizes a dual tax rate.

Worcester’s average residential tax burden is also lower than surrounding communities. Also, the cost per square foot is less than half of neighboring towns. This results in Worcester residents getting a greater value for their dollar. An average home’s price per square foot in 2016 for Worcester was $92 with the next highest cost being $143 in Millbury. Meanwhile, Worcester enjoys the second lowest residential property taxes among five abutting towns at $3,916 annually. The city also retains the lowest actual home price at $187,815.

‘You get a better home here’

Even during some past years in which Worcester’s commercial rate was lowered, it still didn’t result in significant savings. “You were still getting better quality and value for homes in a dollar per square foot than people in neighboring communities with lower rates were,” said Stuart Loosemore, Esq, the Worcester Chamber’s General Counsel & Director of Government Affairs and Public Policy. “You get a better home here for a lower number. We’ve tried to move away from it’s just the rate as that is only part of the equation.”

Feeling the impact

One downside to TIFs is most small businesses lack the financial resources to pursue them. Many end up competing directly against larger companies that develop locally as a result of being awarded TIFs.

Alex Trenta, owner of Prime-Air Blower, Inc., chose to start his business in Worcester. “Everything is nearby or right around the corner,” he says. Trenta’s prime location includes the rail port authority, which exports his products from Main South to overseas buyers. So Trenta decided it would be a good investment to rent space in at 118 Cambridge St., and would provide security to the tenants. Since 2012, Trenta’s tax bills have increased to well over $8,000. Prime-Air continues to shoulder more of the burden.With high taxes and health care as well as increasing sewer and water rates, Trenta is finding it hard to operate.

EVO faces challenge

Likewise, the Maykels opened the popular EVO restaurant in Worcester in 2008. Like many successful business owners, the Maykels have considered expanding beyond their Chandler Street location and growing their workforce of roughly 48 employees. However, the rising costs for minimum wages, food and inventory, energy, and the city’s high tax rate have left the family-owned business discouraged. Since 2012, the Maykel’s have seen a 13 percent jump in their taxes.

“Small businesses struggle to make ends meet and it is important to our family to continue to provide our customers with a place to purchase natural and organic foods; that becomes harder and harder with ever increasing costs,” said Albert Maykel, Jr. from the Living Earth.

Small business can’t access TIFs

Since 1973, the Stultz family has owned and operated Standard Auto Wrecking on Granite Street in Worcester. Worcester made sense because “it has everything” and their loyal customer base knows where they are located. The auto parts dealer has done everything to keep costs low by modernizing processes but running a company in Worcester has been difficult. In 2012, Standard Auto saw its valuations for three parcels increase by 74 percent, with a 44 percent increase in their taxes.

“We must create a more competitive tax rate,” added Murray. “A majority of smaller businesses don’t have the ability to access a TIF and afford attorneys and accountants to navigate that process. The larger companies are leaving because the commercial tax rate is too high.”